Egypt Real Estate Market Key Stats & Trends 2023-2028

Real Estate Landscape in Egypt Key Statistics and Trends

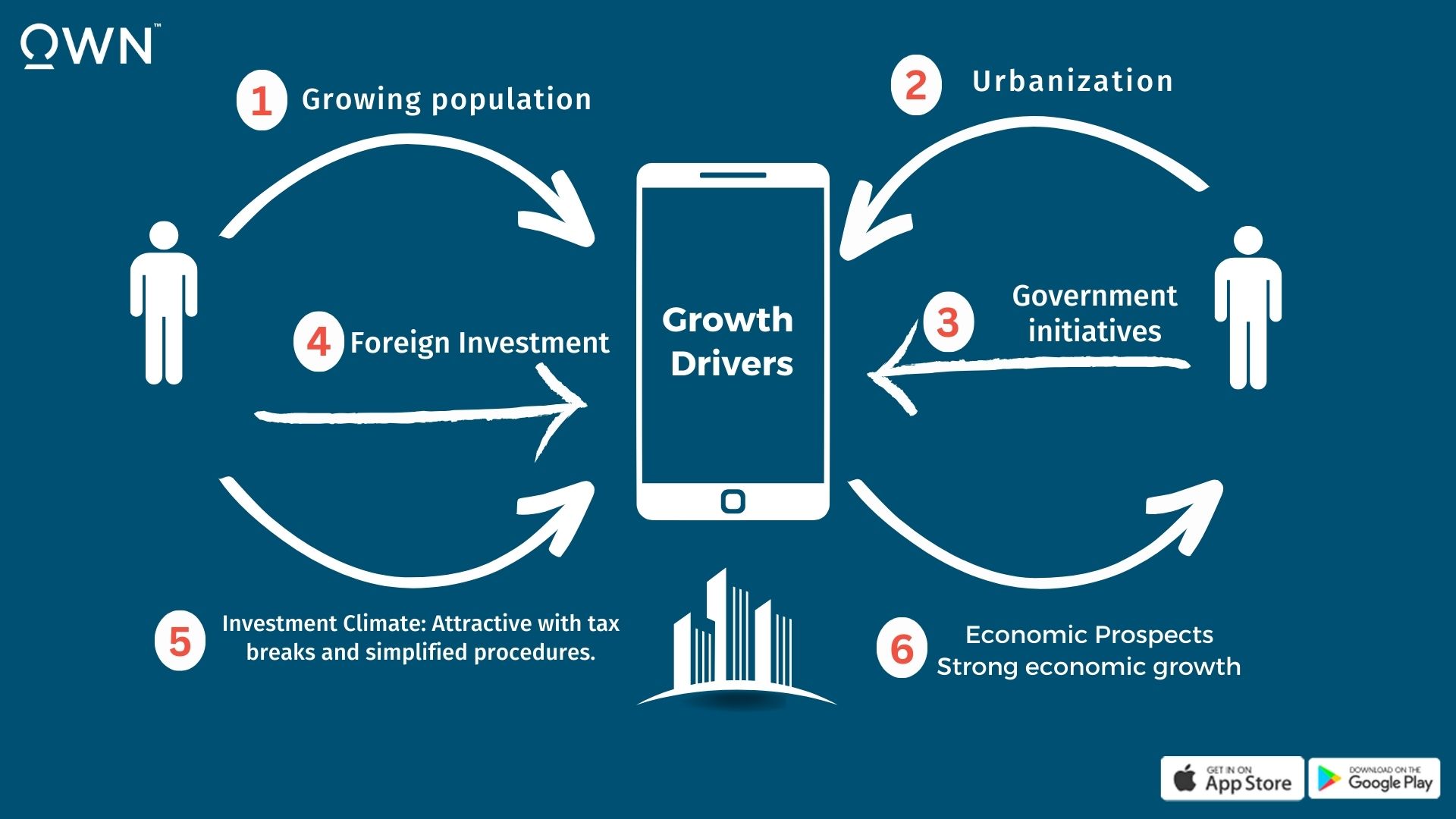

Egypt real estate market 2023 is one of the most dynamic and rapidly growing in the Middle East and North Africa (MENA) region. The sector has benefited from a number of factors, including the country’s growing population, urbanization, and government initiatives to support the industry.

Key Statistics

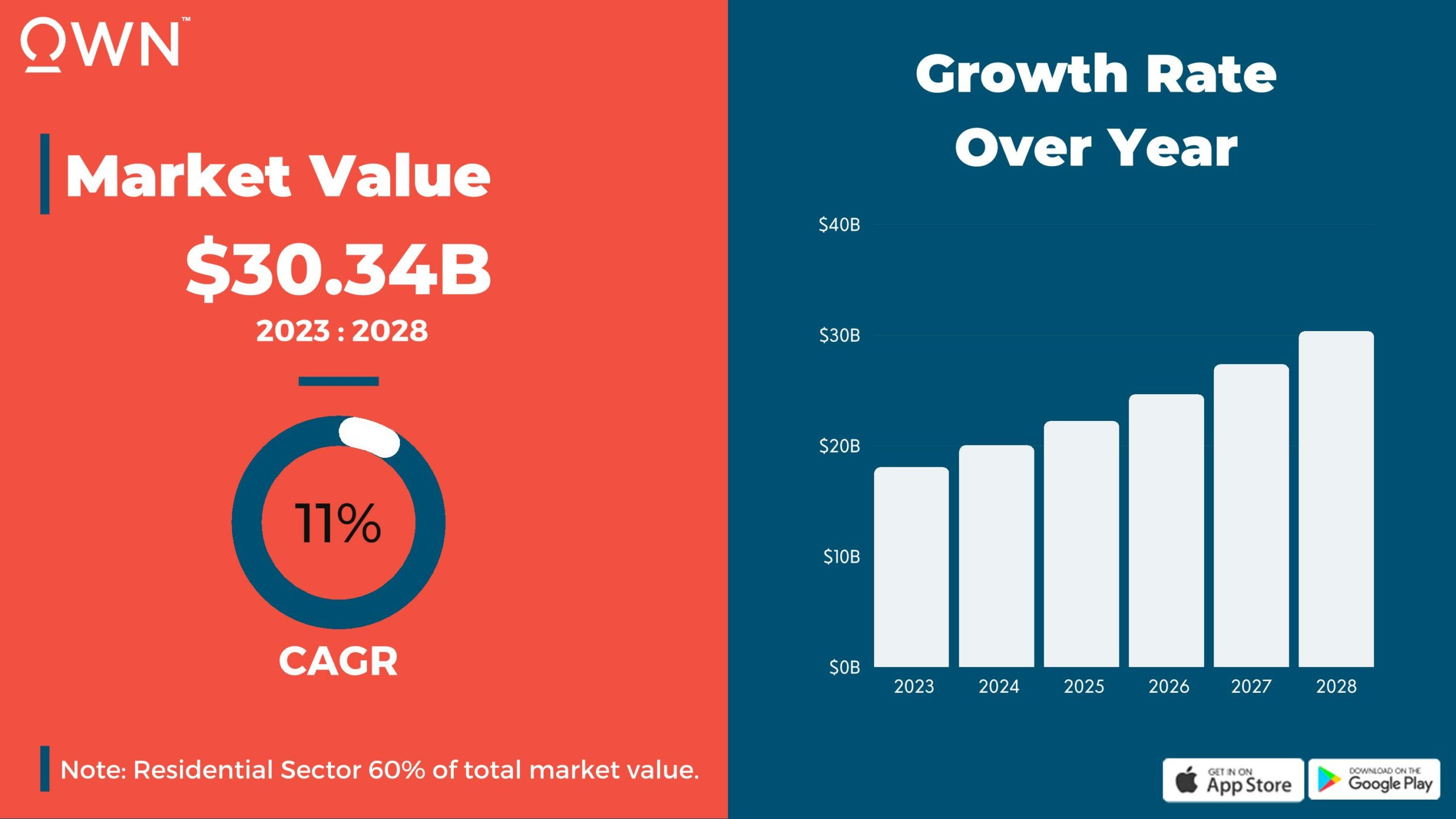

The Egyptian real estate market is expected to grow at a CAGR of 10.96% between 2023 and 2028, reaching a value of USD 30.34 billion by 2028.

The residential sector is the largest segment of the Egyptian real estate market, accounting for over 60% of the total market value.

The commercial sector is also growing rapidly, driven by the expansion of the country’s services sector.

Cairo is the largest real estate market in Egypt, followed by Alexandria and Giza.

The Red Sea resort towns of Sharm el-Sheikh and Hurghada are also popular destinations for real estate investors.

Key Trends

Growth in the luxury housing market: Demand for luxury housing is growing rapidly in Egypt, driven by the country’s growing middle class and affluent population.

Increased foreign investment: Foreign investment in the Egyptian real estate market is also on the rise, attracted by the country’s strong economic growth and attractive investment climate.

Government support: The Egyptian government is also actively supporting the real estate sector through a number of initiatives, such as the development of new cities and the provision of subsidies for affordable housing.

FAQs

What are the main types of real estate in Egypt?

The main types of real estate in Egypt include:

Residential real estate: This includes apartments, houses, and villas.

Commercial real estate: This includes offices, retail space, and industrial warehouses.

Hospitality real estate: This includes hotels, resorts, and serviced apartments.

Land: This includes agricultural land, undeveloped land, and land for development.

What are the most popular locations for real estate investment in Egypt?

The most popular locations for real estate investment in Egypt include:

Cairo: Cairo is the capital and largest city of Egypt, and it is home to a thriving real estate market.

Alexandria: Alexandria is the second-largest city in Egypt and a popular tourist destination.

Giza: Giza is home to the Pyramids of Giza, one of the Seven Wonders of the Ancient World.

Red Sea resorts: The Red Sea resorts of Sharm el-Sheikh and Hurghada are popular destinations for tourists and real estate investors alike.

New cities: The Egyptian government is developing a number of new cities, such as New Cairo and New Administrative Capital, which are also popular destinations for real estate investment.

What are the benefits of investing in real estate in Egypt?

There are a number of benefits to investing in real estate in Egypt, including:

Strong economic growth: Egypt’s economy is growing rapidly, which is driving demand for real estate.

Attractive investment climate: Egypt offers a number of incentives to foreign investors, including tax breaks and simplified investment procedures.

Growing population: Egypt’s population is growing rapidly, which is creating demand for new housing and commercial space.

Affordable prices: Real estate prices in Egypt are still relatively affordable compared to other developed and emerging markets.

What are the risks of investing in real estate in Egypt?

There are also some risks associated with investing in real estate in Egypt, including:

Currency volatility: The Egyptian pound has been volatile in recent years, which could impact the value of real estate investments.

Political instability: Egypt has experienced political instability in recent years, which could also impact the real estate market.

Regulatory challenges: The Egyptian government is in the process of updating its real estate regulations, which could impact investors.

Overall, the real estate market in Egypt is a dynamic and rapidly growing sector that offers a number of opportunities for investors. However, investors should carefully consider the risks involved before making any investment decisions.